What happened

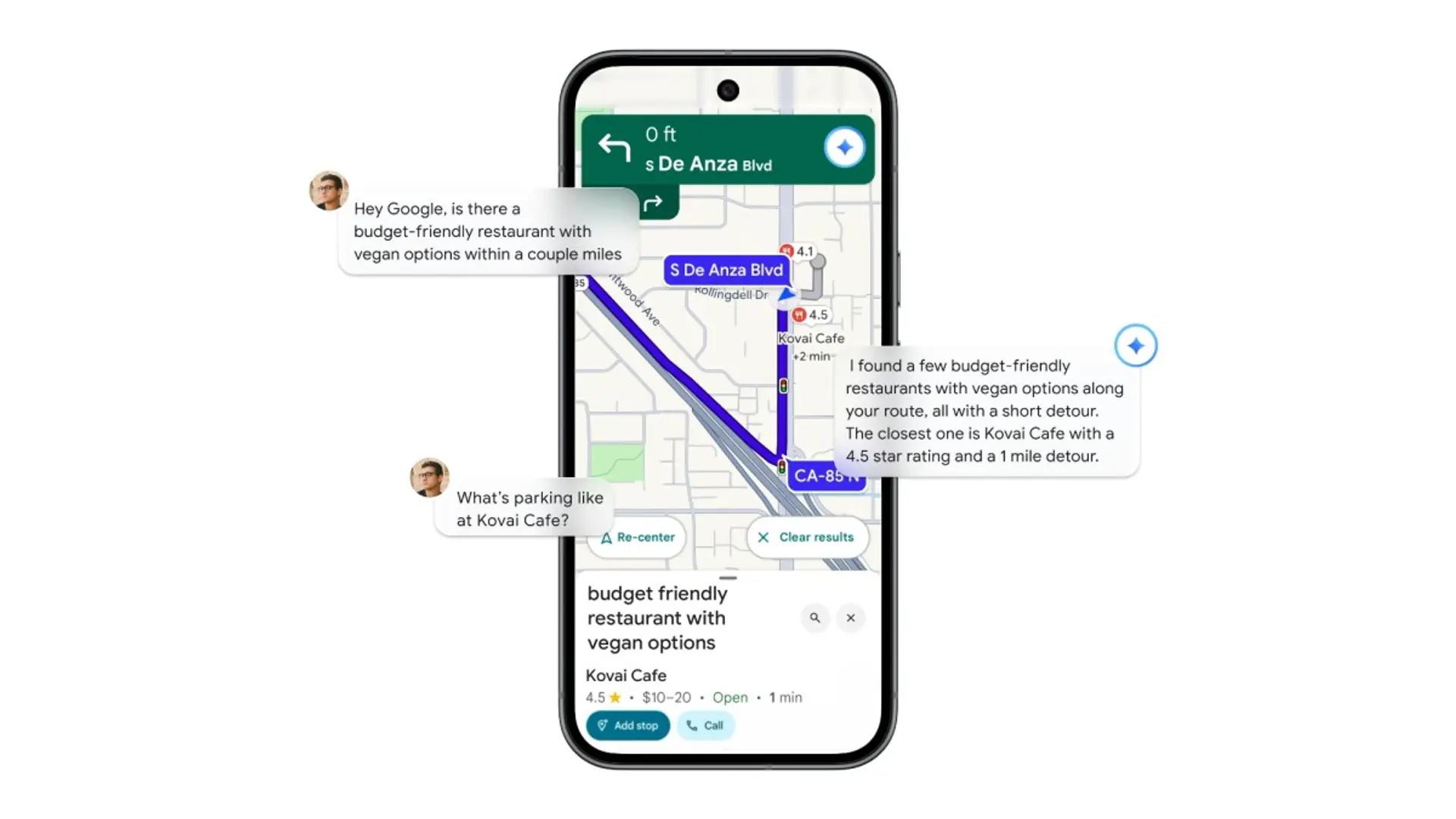

Alphabet introduced the Gemini 3 AI model, utilising custom-designed Tensor Processing Units (TPUs) to power its artificial intelligence initiatives. This vertical integration reduces reliance on third-party chipmakers. Google Cloud also demonstrated revenue growth exceeding competitors, with AI capabilities deployed into Google Search and its enterprise cloud stack. This strategy maintains the flagship product's central role in AI development.

Why it matters

The deployment of proprietary AI models and custom hardware introduces a dependency constraint on Google's integrated ecosystem for AI-driven operational capabilities. This vertical integration increases due diligence requirements for procurement and platform operators regarding potential vendor lock-in and future interoperability. IT security and compliance teams face an increased oversight burden due to reduced transparency in the underlying infrastructure and its implications for data governance.