The global surge in artificial intelligence is drawing attention to the financial forecasts of Taiwan Semiconductor Manufacturing Co. and Samsung Electronics Co. As key players in chip manufacturing, their upcoming earnings reports are expected to provide insights into the sustainability of the AI boom.

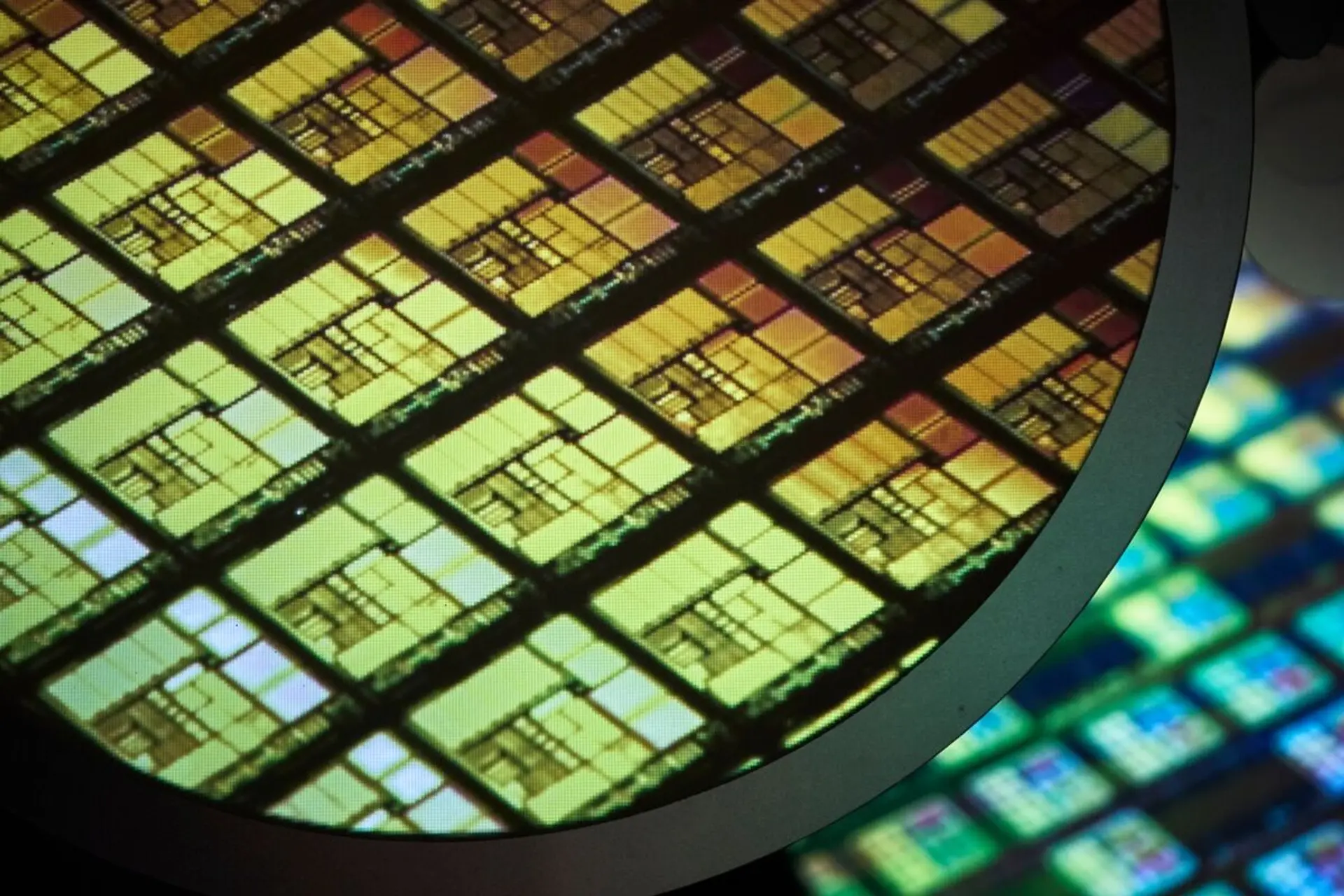

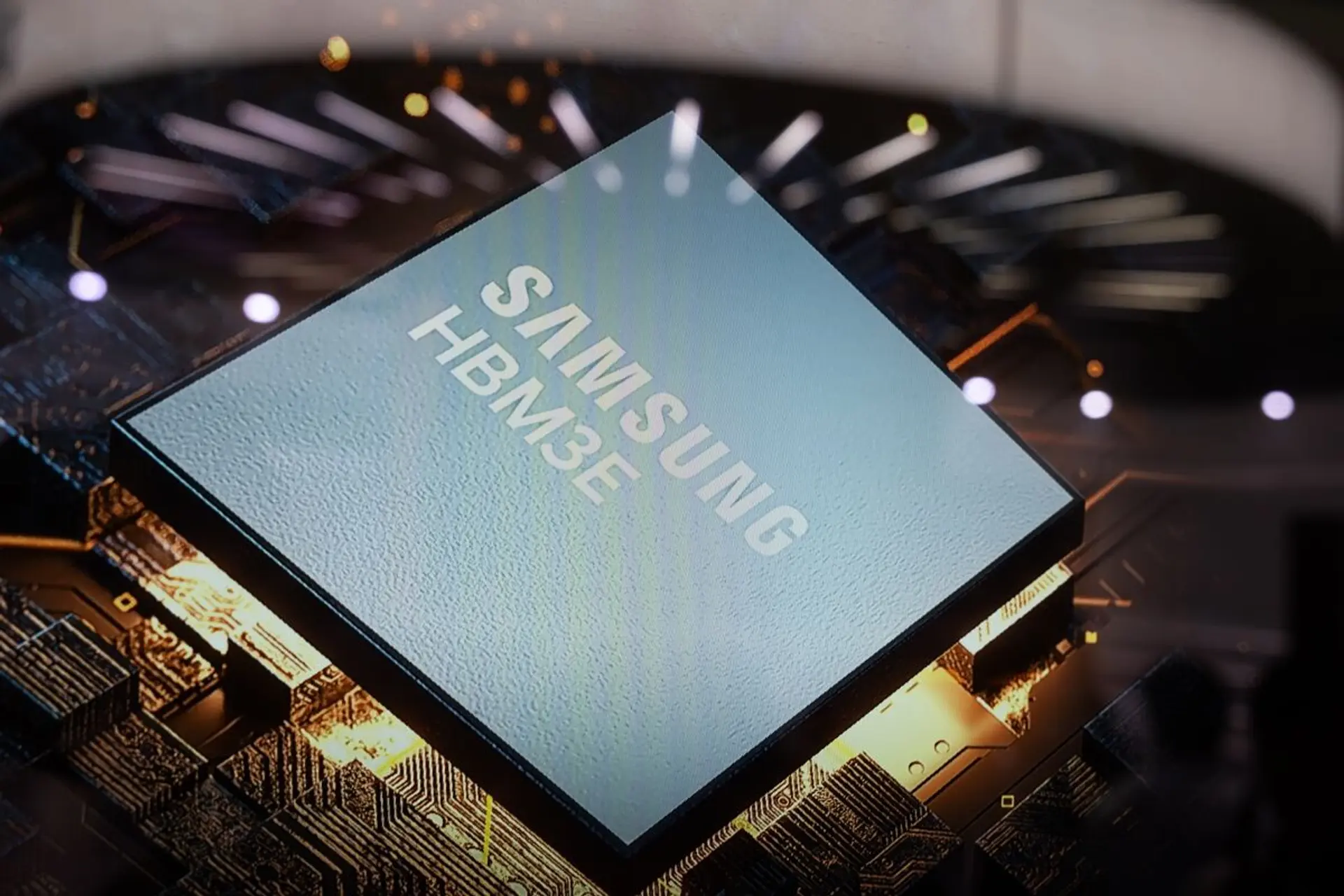

TSMC is currently leading the foundry market with a 67.6% market share, while Samsung holds 7.7%. TSMC's advanced 3nm chip manufacturing process boasts a 90% yield rate, outperforming Samsung's 50%. Despite Samsung's efforts to innovate with 2nm GAA technology and secure AI partnerships, they still lag behind TSMC in process maturity and yield rates. Foreign investors are showing confidence in Korean semiconductor stocks, with significant investments in Samsung Electronics and SK Hynix. Morgan Stanley has raised Samsung Electronics' target price by 14% to 111,000 Korean won, anticipating benefits from AI-driven demand and DRAM market recovery.

Analysts project TSMC to maintain a dominant market share of 60-65% by 2030, while Samsung could potentially capture 10-15% if they address yield challenges and accelerate GAA adoption. The AI sector is expected to drive substantial growth for these companies, with AI chip demand predicted to outpace traditional semiconductors.