What happened

Tem raised $75 million in a funding round led by Lightspeed to scale its AI electricity transaction engine. Platform automates energy procurement and trading to bypass traditional brokers and reduce costs. Tem will use capital to expand operations into US and Australia. Technology uses machine learning to match supply and demand directly within wholesale markets. Investment supports deployment of algorithmic trading infrastructure across international energy grids.

Why it matters

Energy procurement teams and grid operators can bypass traditional brokers because Tem’s engine automates direct market access. Removing intermediary fees reduces transaction overhead. Investment follows Edison Scientific’s $70 million raise in December, confirming a pattern of capital concentration in AI-driven physical infrastructure. Platform engineers face new integration requirements as energy markets shift from manual brokerage to algorithmic execution. Result: incumbents lose price control as transparent AI matching scales.

Related Articles

US DFC Expands Tech Investments

Read more about US DFC Expands Tech Investments →

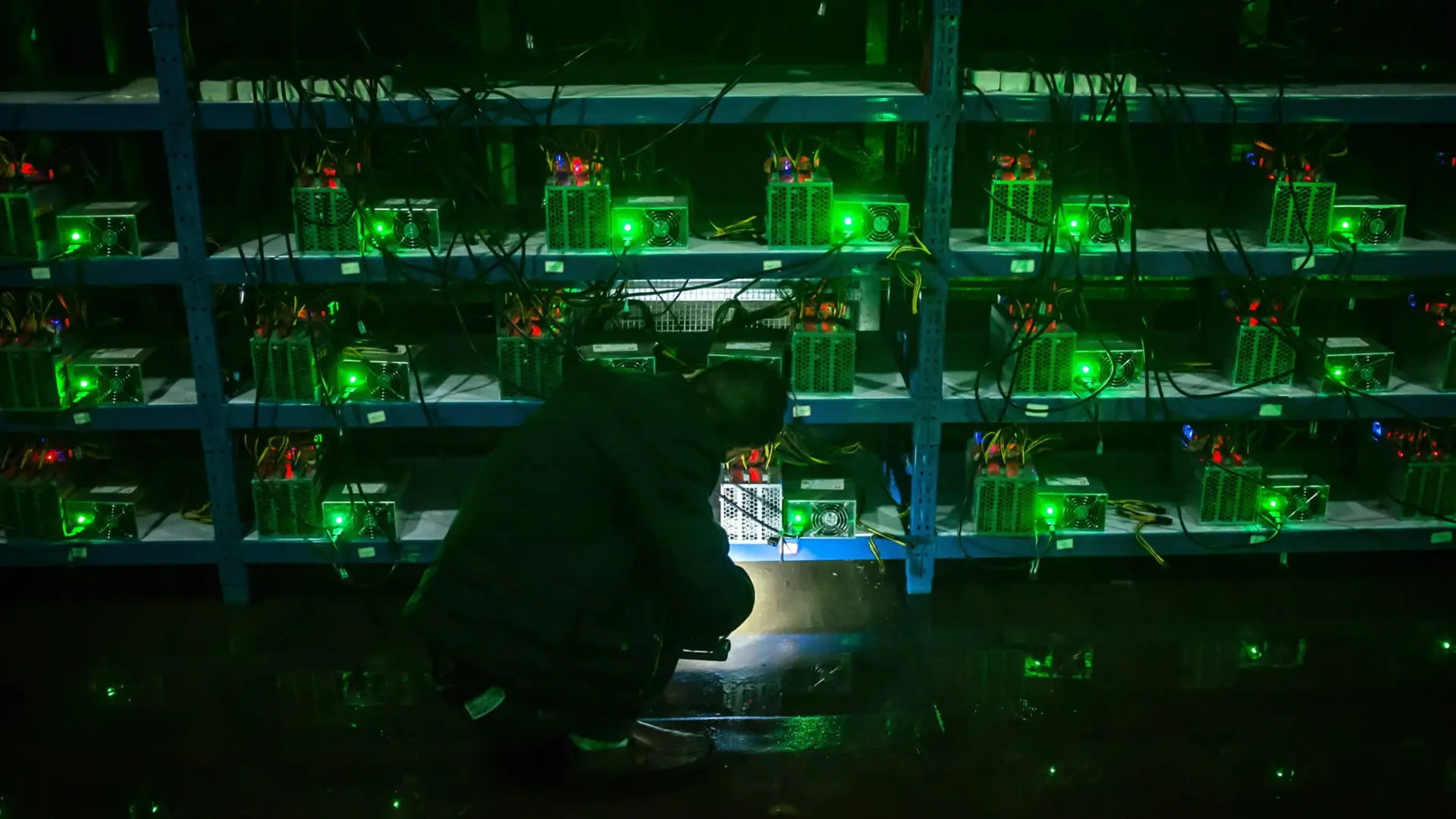

US Miners Pivot to AI Compute

Read more about US Miners Pivot to AI Compute →

Big Tech Commits $660B to AI

Read more about Big Tech Commits $660B to AI →

Trump Urges Data Centre Power Bids

Read more about Trump Urges Data Centre Power Bids →