What happened

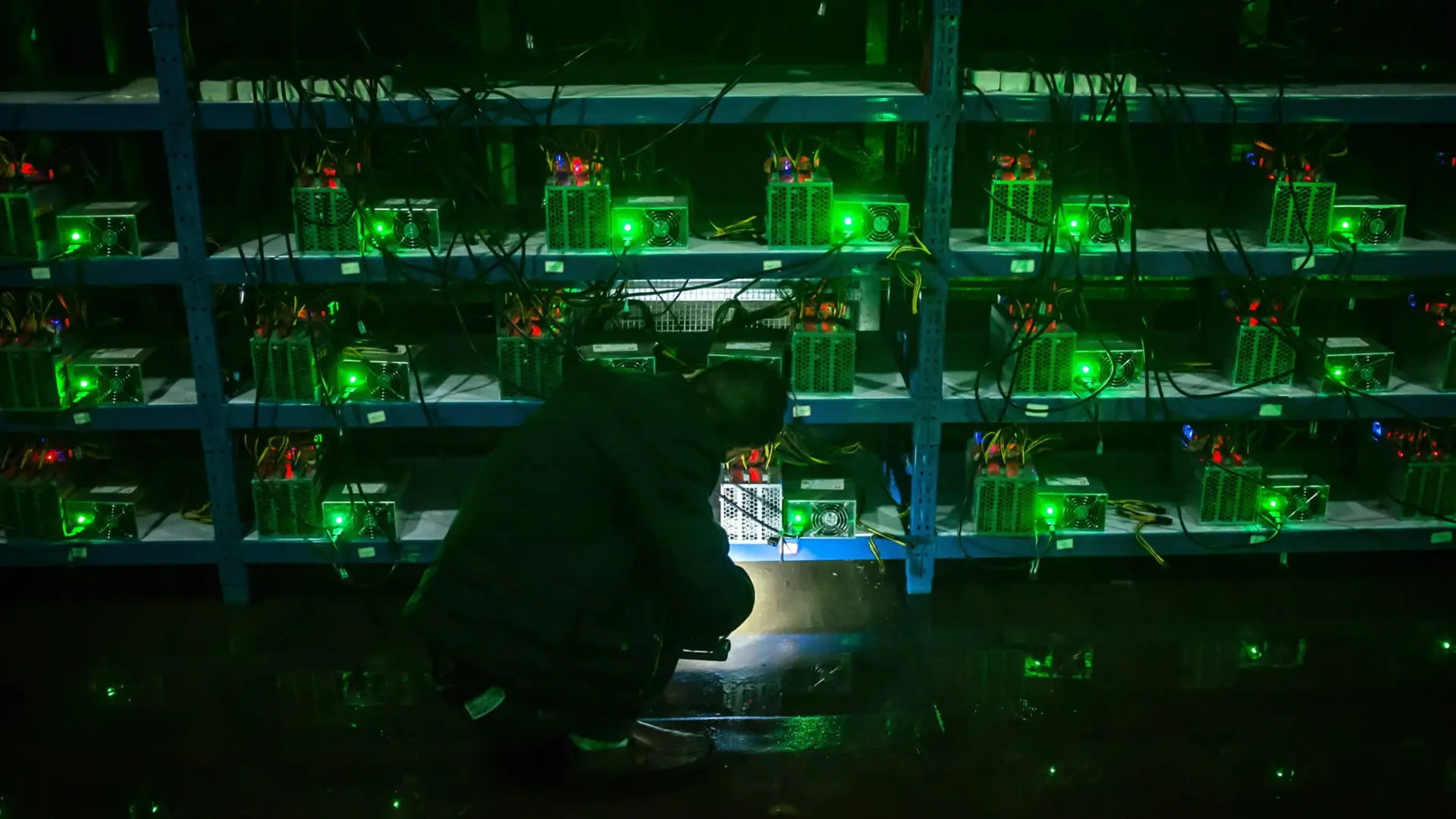

US bitcoin mining companies are repurposing their high-performance computing infrastructure to support artificial intelligence workloads. This strategic pivot, reported by the Financial Times on 8 February 2026, shifts operational focus from cryptocurrency mining to AI processing demands. Mining firms are leveraging substantial investments in data centres and power infrastructure, originally deployed for energy-intensive bitcoin validation, to meet escalating demand for AI compute capacity. This transition involves re-tasking or upgrading existing hardware for new computational uses.

Why it matters

This pivot affects platform engineers, data centre operators, and investors in both crypto and AI. It reduces the supply of dedicated bitcoin mining capacity, potentially impacting network security and transaction costs for crypto users. Therefore, it increases available high-performance compute for AI development, accelerating model training and deployment. This pattern follows recent US tech stock rebounds and anticipated IPO surges, indicating a broader capital reallocation towards AI infrastructure.

Related Articles

Big Tech Commits $660B to AI

Read more about Big Tech Commits $660B to AI →

AI's Debt-Fueled Expansion

Read more about AI's Debt-Fueled Expansion →

ByteDance Invests Heavily in AI

Read more about ByteDance Invests Heavily in AI →

US DFC Expands Tech Investments

Read more about US DFC Expands Tech Investments →