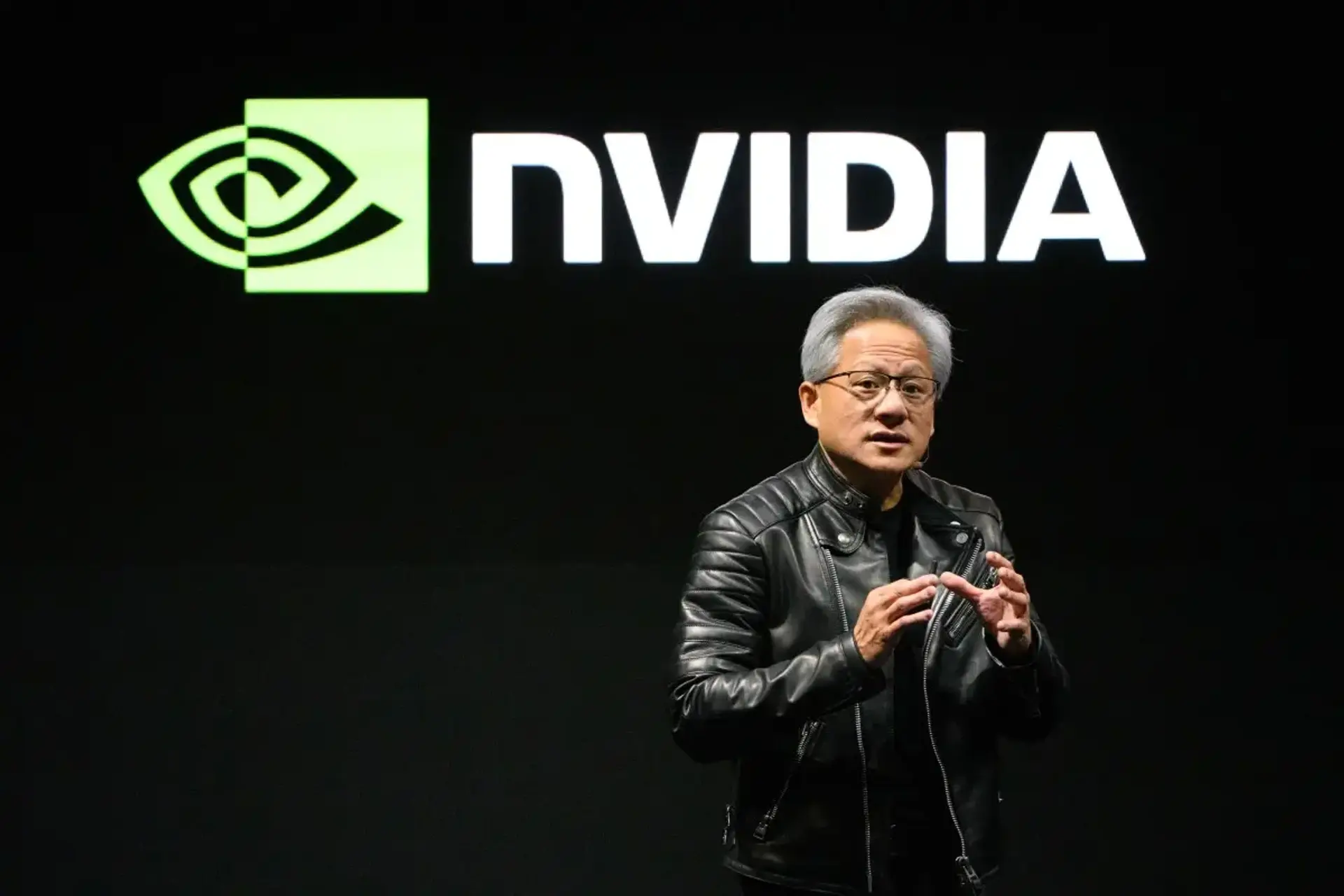

Cambricon Technologies, a Chinese AI chip designer, has emerged as a strong domestic competitor to Nvidia, fuelled by software compatibility and strategic partnerships. The company's stock price has surged, positioning it as a key player in China's efforts to reduce reliance on US technology. Cambricon posted a record profit of 1.03 billion yuan in the first half of 2025, driven by soaring domestic AI chip demand. This represents concrete proof that China's domestic AI ecosystem can thrive despite American restrictions.

Backed by Beijing, Cambricon aims to capture a significant share of China's AI chip market. Publicly owned computing hubs are being asked to source more than 50% of their chips from domestic producers, boosting demand for companies like Cambricon. However, despite the rise of domestic alternatives, demand for Nvidia's AI chips remains strong in China due to the limited supply and superior performance of Nvidia's products.

Cambricon's stock recently experienced a sharp decline, with shares slumping 14.4%, highlighting the risks associated with the company's high valuation. Despite this, Cambricon is still up nearly 83% this year, with a market value of 502.8 billion yuan. The company plans to raise nearly 4 billion yuan (US$560 million) for AI chip development, further solidifying its position in China's tech self-sufficiency drive.

Related Articles

Nvidia's Growth Faces China Hurdles

Read more about Nvidia's Growth Faces China Hurdles →

Cambricon Stock Price Soars

Read more about Cambricon Stock Price Soars →

China Rejects Nvidia's H20

Read more about China Rejects Nvidia's H20 →

Nvidia Develops China-Specific AI Chip

Read more about Nvidia Develops China-Specific AI Chip →