Norway's sovereign wealth fund, a major global equity investor, is set to implement AI-driven strategies to slash trading expenses. Managing a portfolio with 46 million annual trades, the fund aims to save up to $400 million by leveraging AI to optimise trading decisions and execution. This move reflects a growing trend among large institutional investors to adopt advanced technologies for enhanced efficiency and cost reduction in financial markets. The fund's initiative could set a new benchmark for how sovereign wealth funds utilise AI to improve investment performance and operational efficiency.

The AI system will analyse vast datasets to identify optimal trading opportunities, predict market movements, and automate trade execution. By reducing reliance on human traders and minimising transaction costs, the fund expects to achieve significant savings. This technological upgrade underscores the increasing importance of AI in the financial sector, where data-driven insights and algorithmic trading are becoming essential for maintaining a competitive edge. The adoption of AI by such a prominent player could encourage other large funds to explore similar solutions, further accelerating the integration of AI in global financial markets.

Related Articles

Microsoft's AI Fuels Cloud Surge

Read more about Microsoft's AI Fuels Cloud Surge →

Microsoft's Phi-4 Model Debuts

Read more about Microsoft's Phi-4 Model Debuts →

Alibaba releases upgraded Qwen 3

Read more about Alibaba releases upgraded Qwen 3 →

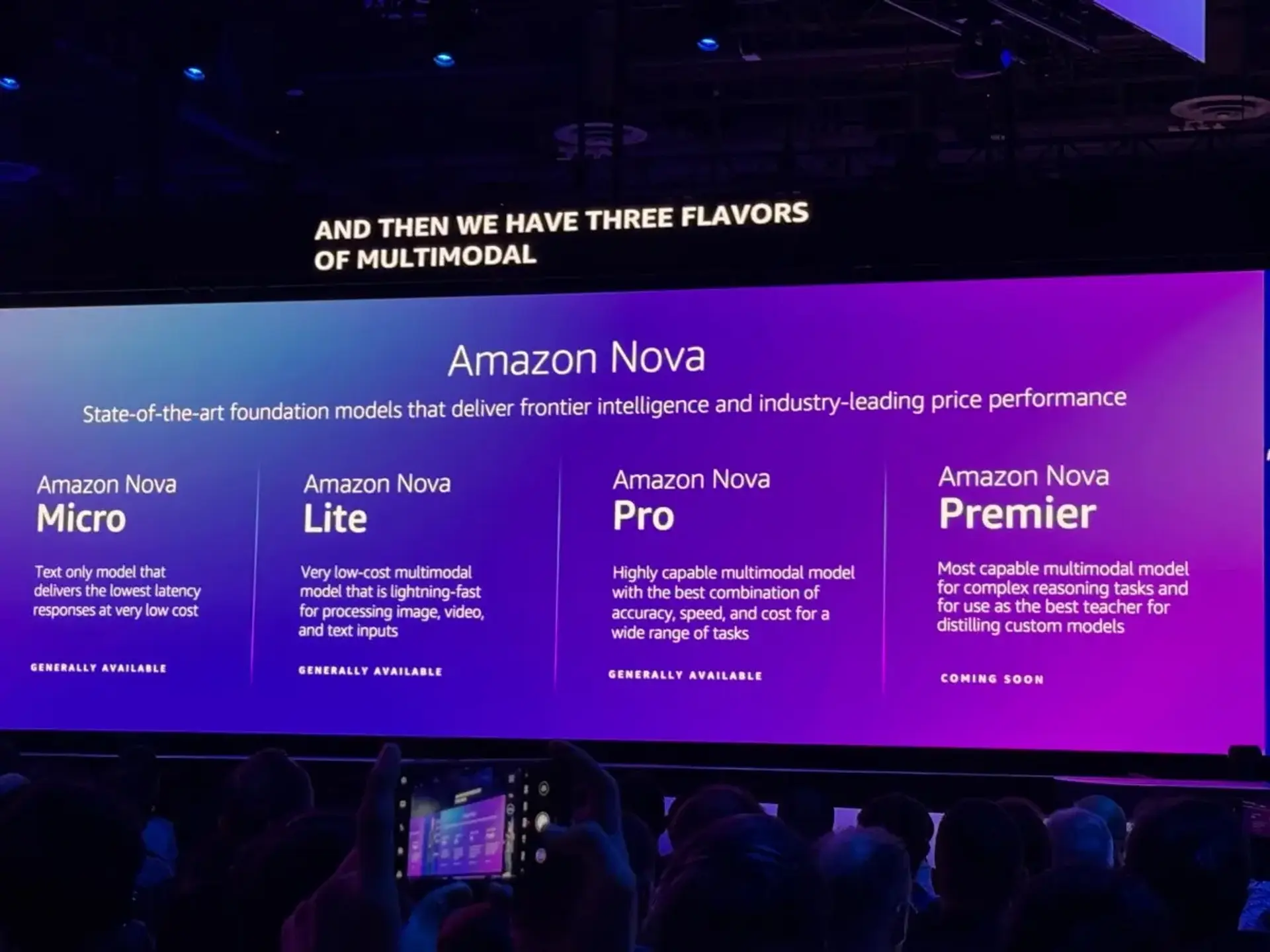

Amazon's Nova Premier Arrives

Read more about Amazon's Nova Premier Arrives →