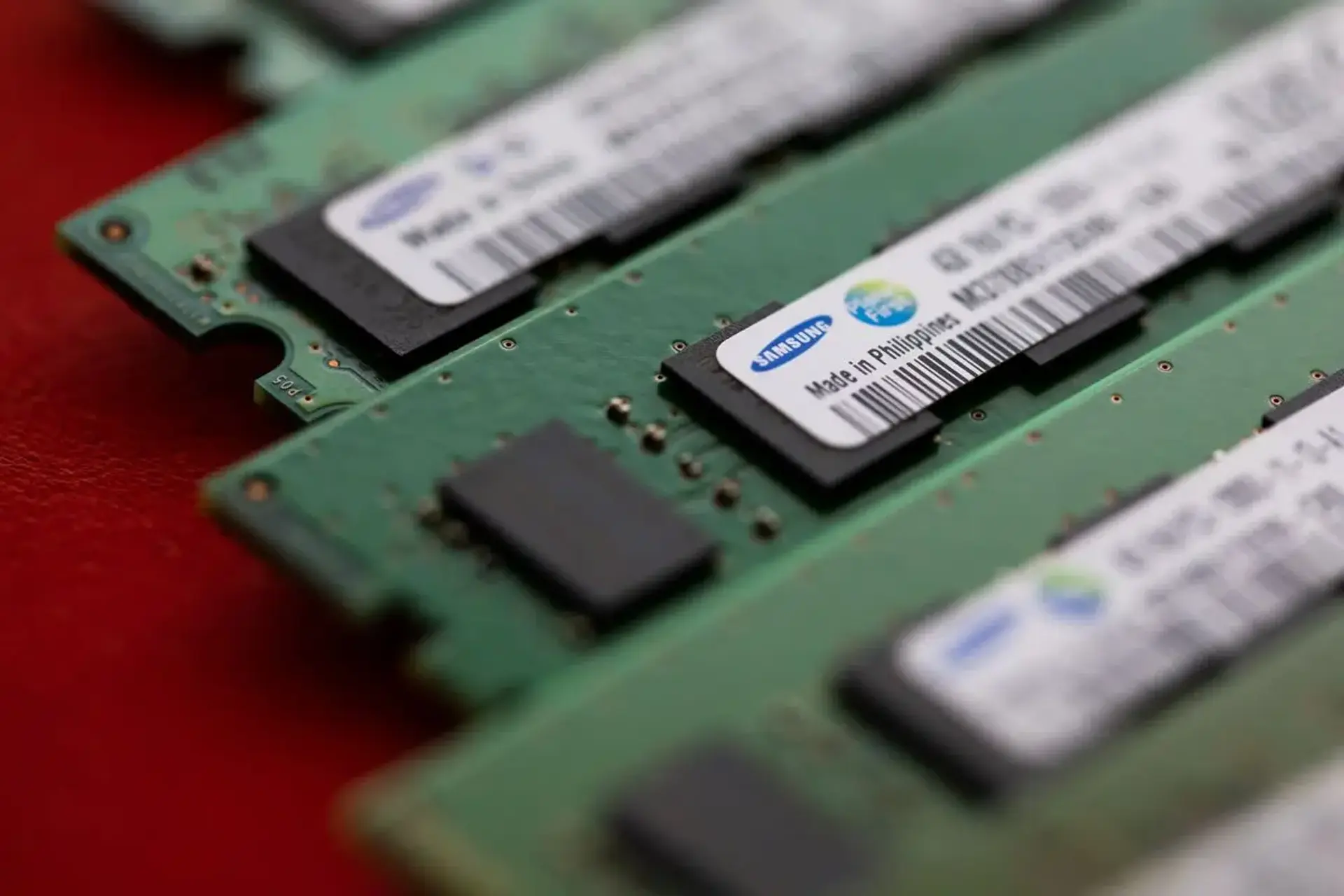

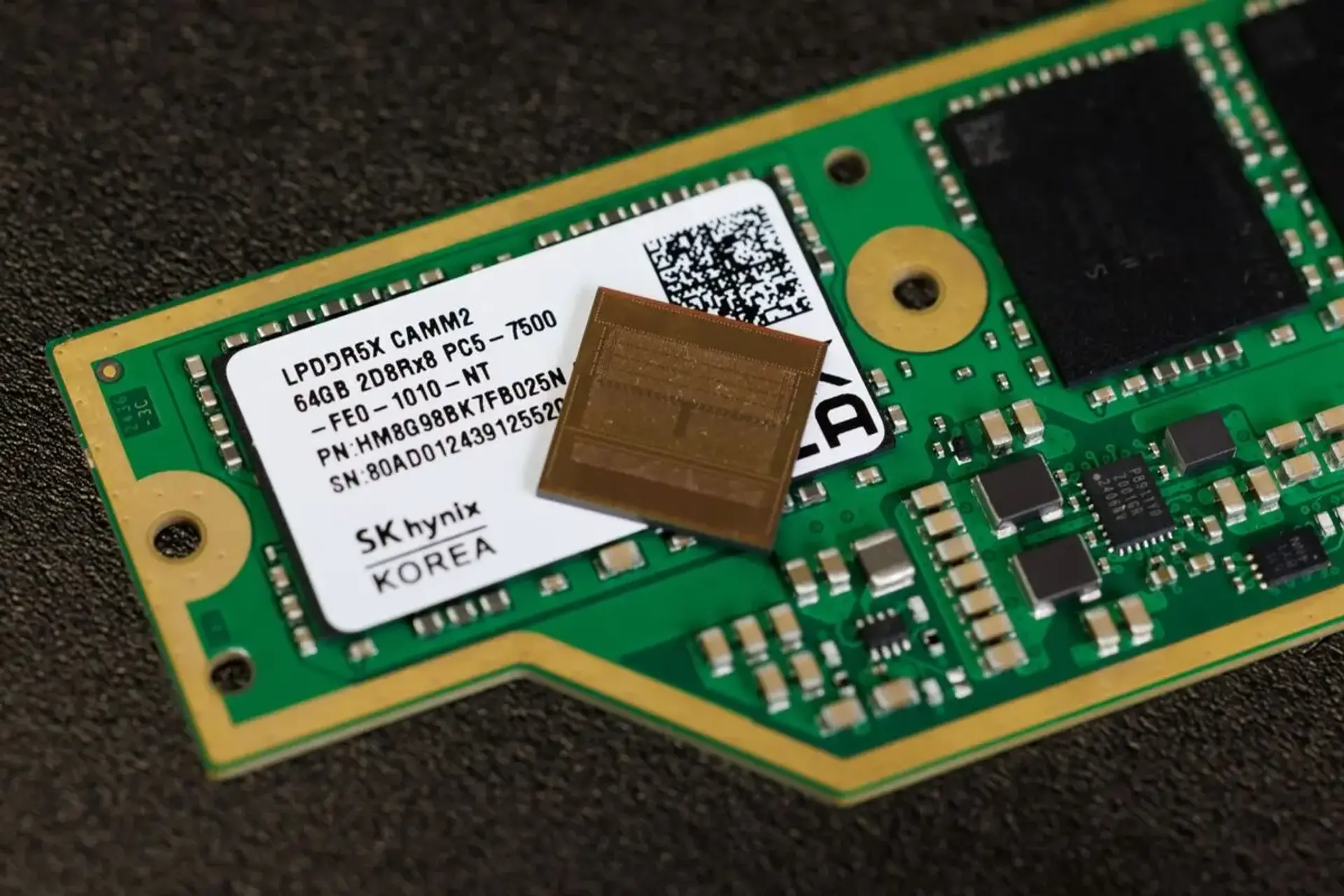

Samsung's chip business has outperformed expectations, despite indications of a slowdown in demand for storage chips. This is a potential signal that the US-China trade tensions might be impacting investment in AI hardware. The company's recent success is attributed to a strategy of stockpiling components, which has allowed them to navigate supply chain uncertainties and meet customer demands effectively. However, the broader implications of the trade war on the semiconductor industry remain a concern, with potential ripple effects on technology development and deployment.

The slower profit growth reported by Samsung underscores the cautious sentiment in the market. While the stockpiling strategy provided a buffer, the long-term sustainability of this approach is questionable amid fluctuating global economic conditions. The company's performance is closely watched as a bellwether for the electronics industry, and its results reflect the complex interplay of technological innovation, geopolitical factors, and market demand.

Looking ahead, Samsung's ability to adapt to changing market dynamics will be crucial. This includes diversifying its customer base, investing in next-generation technologies, and carefully managing its supply chain to mitigate risks associated with trade uncertainties. The company's strategic decisions will not only impact its own profitability but also shape the broader landscape of the global semiconductor market.