Microsoft and Amazon's capital expenditure is under close observation as they release their earnings reports this week. Investors are keen to see if spending aligns with the ongoing artificial intelligence (AI) boom or indicates a potential slowdown. These figures will provide insights into the companies' strategies regarding data centre infrastructure, essential for AI development and cloud services. Any signs of reduced investment could signal a shift in focus or concerns about the near-term profitability of AI ventures.

Both companies have heavily invested in expanding their cloud infrastructure to support AI workloads, including generative AI and machine learning. Microsoft's partnership with OpenAI and Amazon's AWS offerings have driven significant capital expenditure. Analysts will be looking for details on how these investments translate into revenue growth and market share gains. The reports are expected to reveal whether the tech giants are maintaining their aggressive spending or adopting a more cautious approach amid economic uncertainties.

The capital expenditure trends of Microsoft and Amazon will likely influence market sentiment and investor confidence in the AI sector. A continued strong investment trajectory would reinforce the belief in the long-term potential of AI, while a pullback could trigger concerns about inflated expectations and unsustainable growth. The earnings calls will be crucial for understanding the rationale behind these spending decisions and their implications for the broader tech industry.

Related Articles

Microsoft Outsourcing Software Sales

Read more about Microsoft Outsourcing Software Sales →

AI Infrastructure Investment Evolves

Read more about AI Infrastructure Investment Evolves →

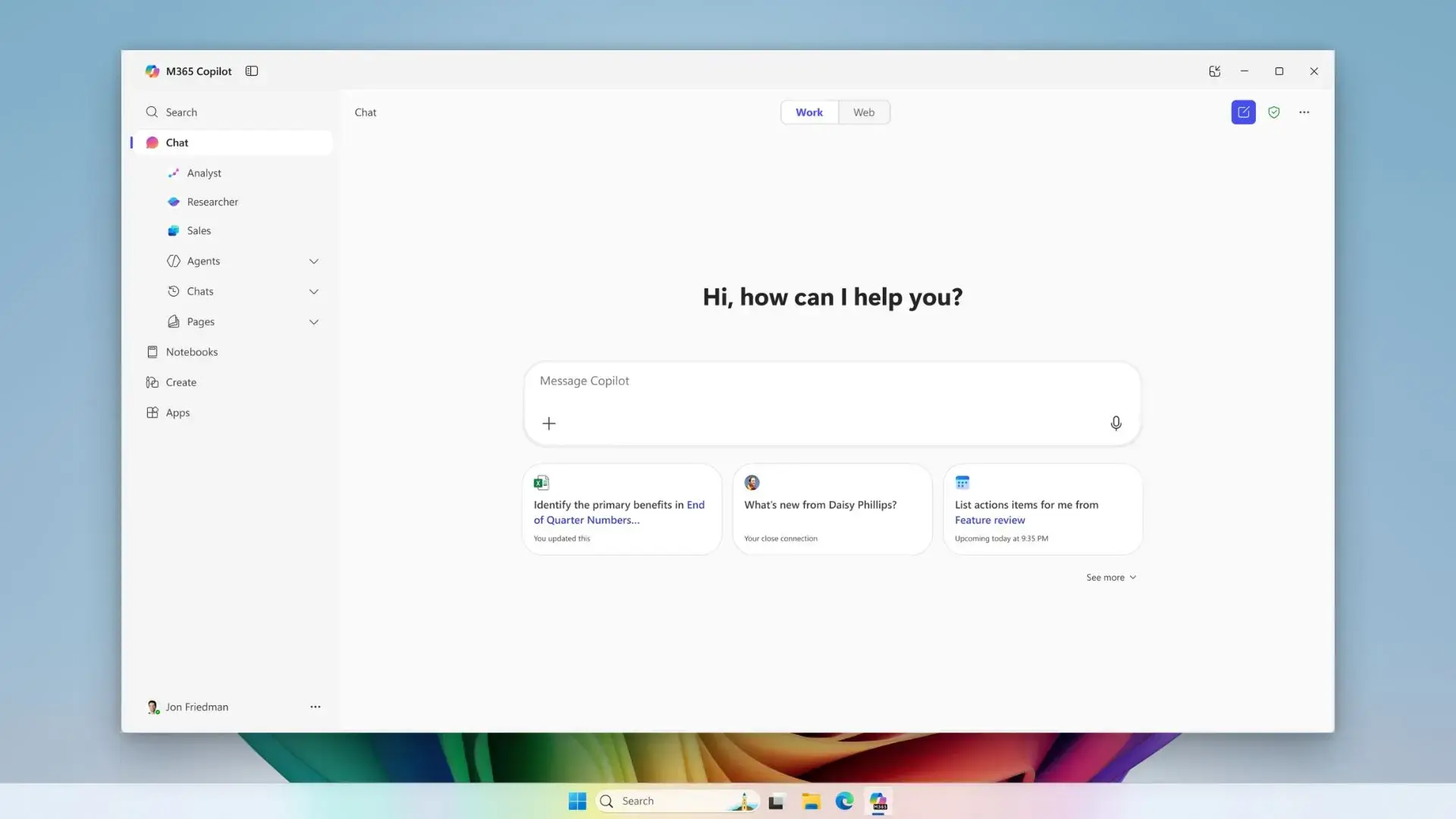

Copilot Embraces ChatGPT-4o

Read more about Copilot Embraces ChatGPT-4o →

Motorola integrates Perplexity, Microsoft AI

Read more about Motorola integrates Perplexity, Microsoft AI →