What happened

Hua Hong Semiconductor Ltd. issued a first-quarter revenue forecast below market expectations. The Chinese chipmaker reported lower projected earnings while domestic competitors accelerate AI chip production. This shortfall follows Beijing's December 2025 mandate prioritising domestic AI chip procurement. Hua Hong maintains focus on mature process nodes as peers pivot to advanced AI hardware. Revenue targets remain below analyst thresholds for the current fiscal period.

Why it matters

Procurement teams face restricted domestic supply for AI-grade silicon because Hua Hong failed to transition from mature nodes to high-performance hardware. This creates a bottleneck for infrastructure architects who must now rely on a smaller pool of domestic vendors. While Samsung and TSMC reported record AI profits in January, Hua Hong’s stagnation proves that domestic preference policies cannot offset technical lag. Resulting supply constraints force founders to pay premiums for limited domestic capacity.

Related Articles

China Prioritises Domestic AI Chips

Read more about China Prioritises Domestic AI Chips →

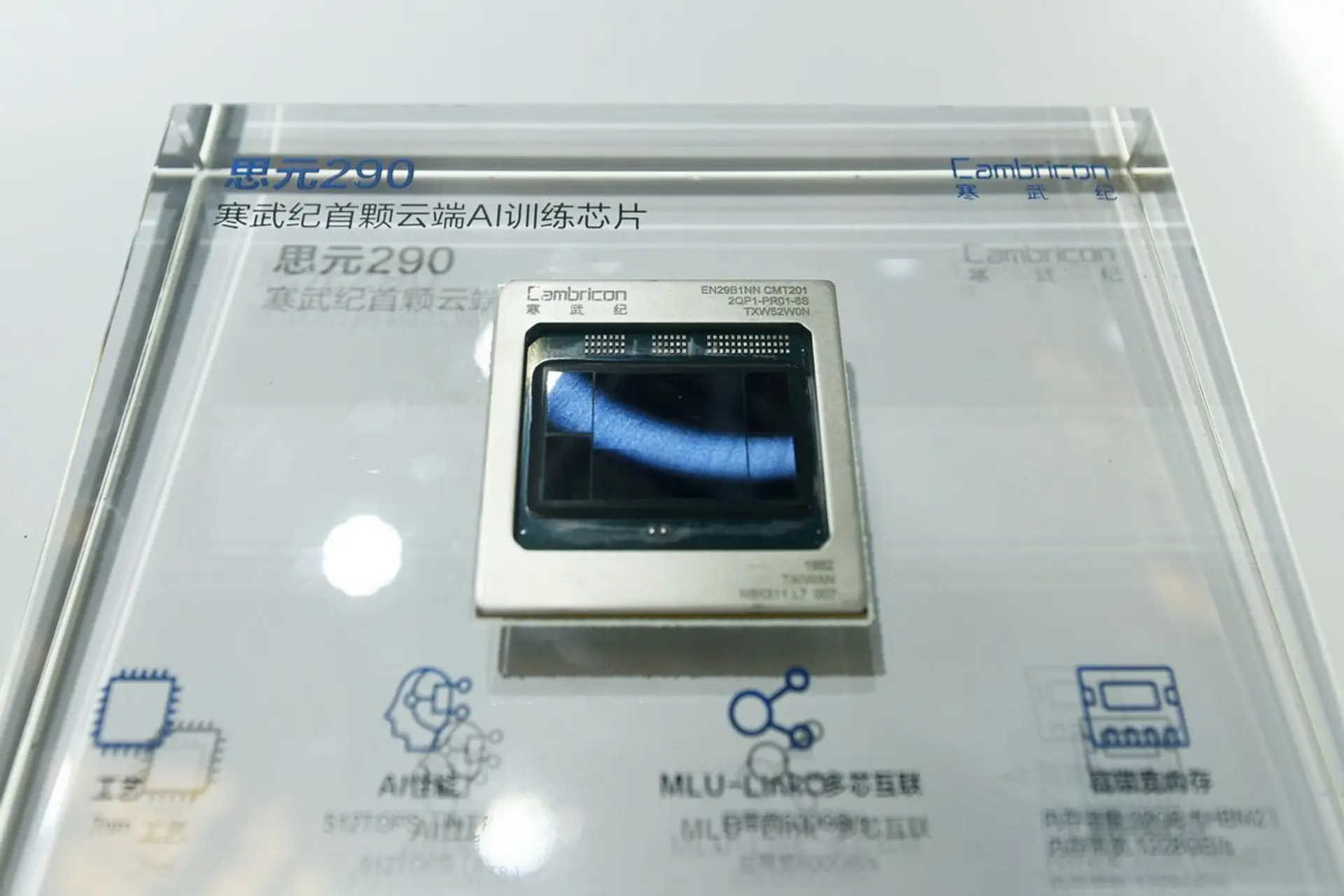

Cambricon to Boost AI Output

Read more about Cambricon to Boost AI Output →

Nvidia China AI Chip Review

Read more about Nvidia China AI Chip Review →

Top Chipmakers Limit Expansion

Read more about Top Chipmakers Limit Expansion →