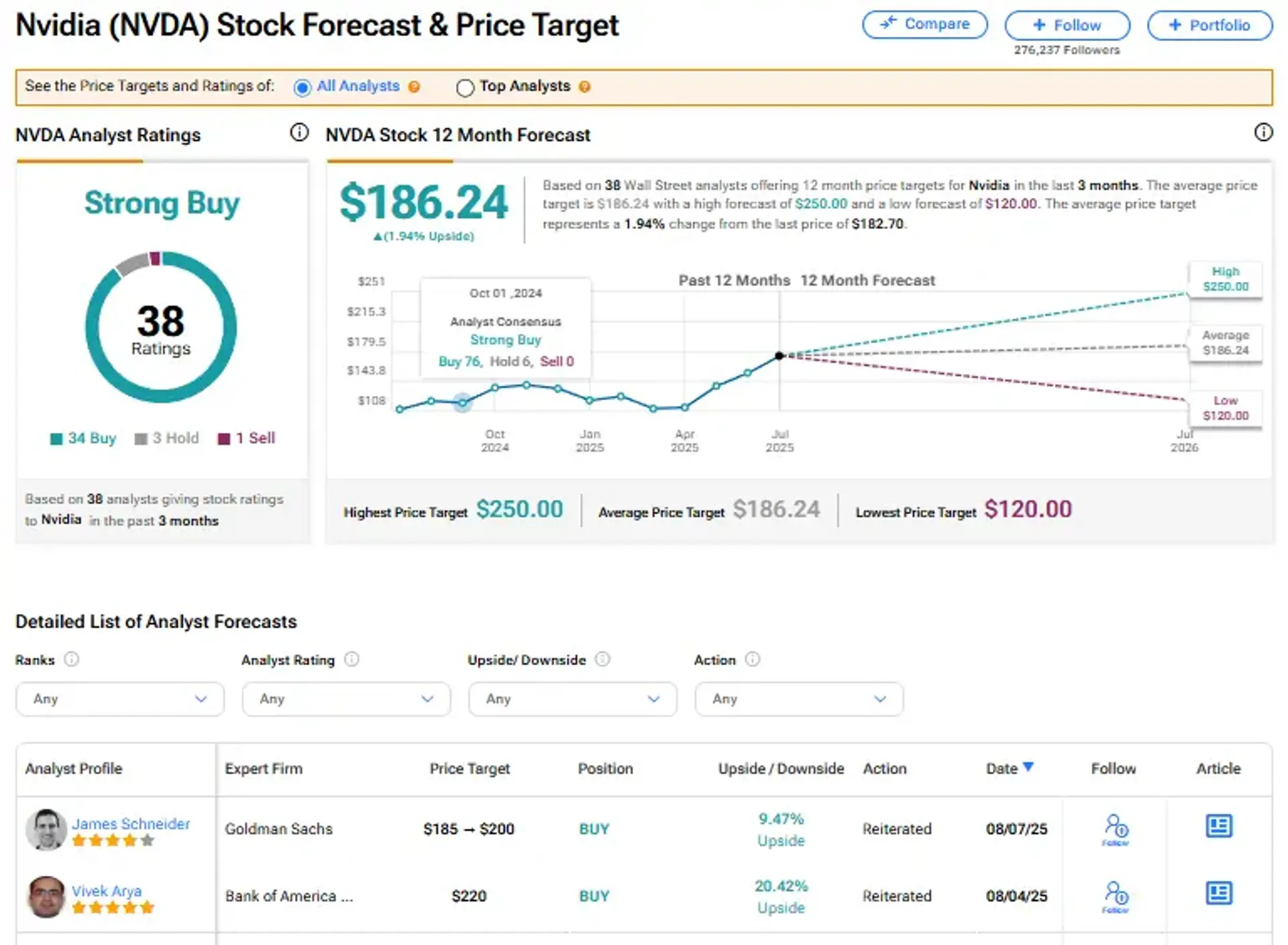

Evercore ISI predicts a 20% surge in the S&P 500 by the close of 2026, projecting the index will reach 7,750 points. This bullish forecast hinges on the transformative impact of artificial intelligence, which is expected to boost both corporate earnings and stock valuations. The optimism is further supported by a technology-led rally, with companies like Nvidia, Meta, and Microsoft experiencing significant stock price increases.

Strategists suggest that AI's influence surpasses that of the internet, permeating various sectors and demonstrating early signs of enhanced corporate productivity. They also acknowledge potential volatility, outlining optimistic and pessimistic scenarios. The S&P 500 could potentially climb to 9,000 if confidence surges or plummet to 5,000 if inflation persists and economic growth stagnates.

Evercore ISI has also revised its S&P 500 target for the end of 2025 to 6,250. This adjustment considers the possibility of market fluctuations and the potential for drawdowns, which are typical in extended bull markets. The firm advises investors to focus on companies that enable, adopt, and adapt to AI technologies across various sectors to maximise potential gains.