The rise of artificial intelligence is reshaping the financial landscape, with companies like Nvidia reaching unprecedented valuations. AI startups are attracting massive investments, signalling a significant shift in market dynamics. Traders are now wary of sectors potentially disrupted by AI, leading to shifts in investment strategies. This reflects a broader concern about the transformative power of AI and its potential to render some traditional business models obsolete. The speed and scale of AI adoption are creating both opportunities and anxieties within the investment community. As AI continues to evolve, its impact on various industries will likely intensify, further influencing investor behaviour and market valuations. This highlights the need for investors to carefully assess the potential risks and rewards associated with AI-driven market disruptions.

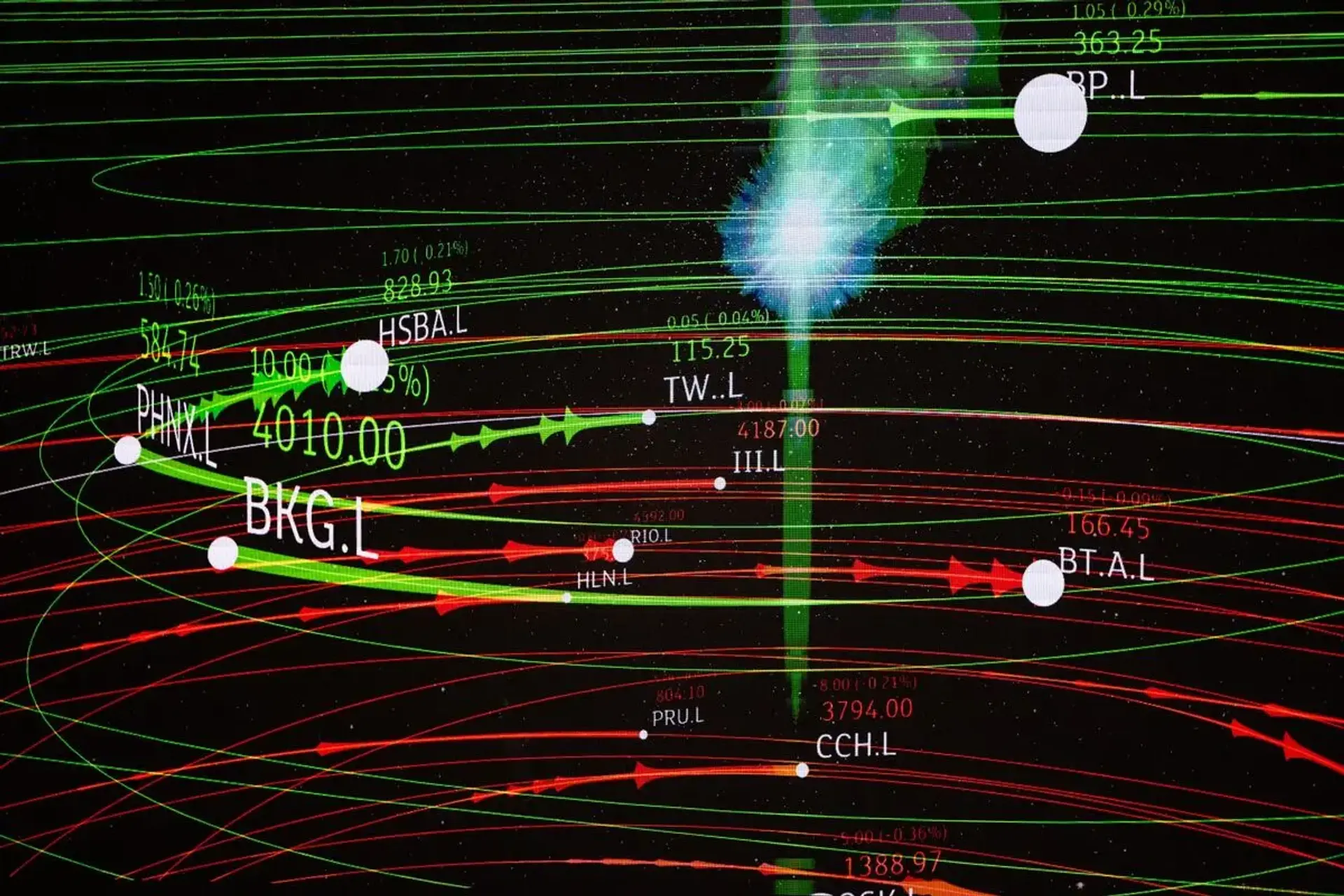

AI's integration into financial markets is also evident through algorithmic trading, sentiment analysis, and automated investment decisions. AI algorithms process vast market data and execute trades at lightning speed, identifying opportunities in real-time. Sentiment analysis gauges market mood by evaluating social media and news, influencing stock price fluctuations. AI automates investment decisions by tracking discussions and news, helping investors adjust portfolios. This evolution offers powerful tools for navigating complex markets, leading to more informed investment strategies. However, it also raises concerns about market opacity and potential manipulation risks, necessitating careful monitoring and regulatory oversight.