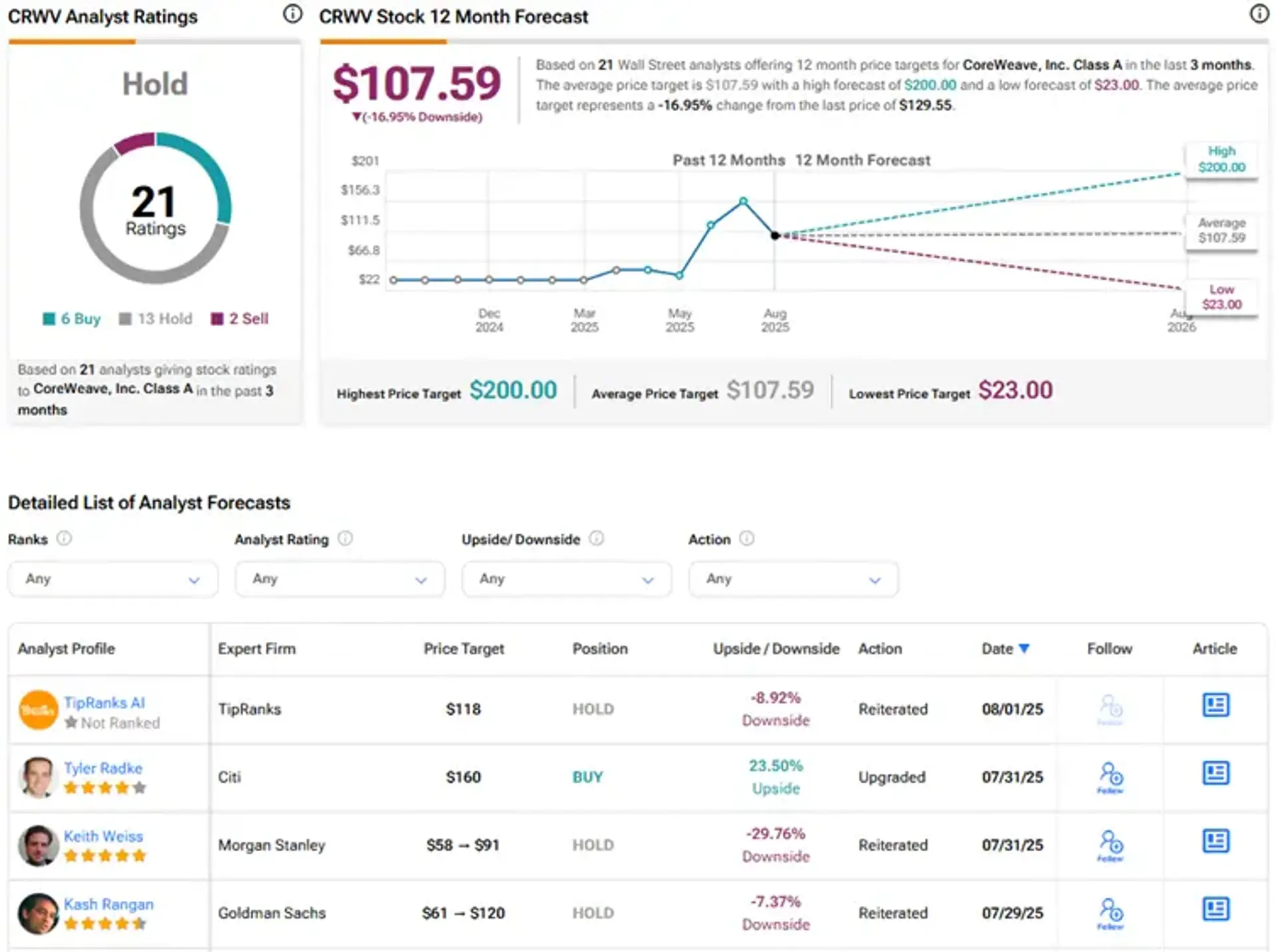

CoreWeave is experiencing renewed investor confidence amid the surge in AI computing demand, with analysts anticipating a strong Q2 earnings report. The company's stock has seen a significant climb as it approaches its potential first billion-dollar quarter, driven by substantial revenue growth. However, this rapid expansion comes with challenges, including increasing losses due to heavy capital expenditure on infrastructure.

Analysts are closely watching CoreWeave's strategic partnerships, particularly its multi-year agreement with OpenAI, and the integration of Core Scientific to bolster data centre capacity. While revenue forecasts are optimistic, concerns remain about the company's high valuation, debt levels, and reliance on major clients like Microsoft. Capital expenditure is projected to remain high as CoreWeave continues to invest in GPU-accelerated cloud solutions.

Despite some analysts adopting a cautious stance, the consensus suggests CoreWeave is well-positioned to benefit from sustained AI spending. The company's ability to translate revenue growth into profitability remains a key focus for investors, as it navigates the balance between aggressive expansion and financial sustainability.