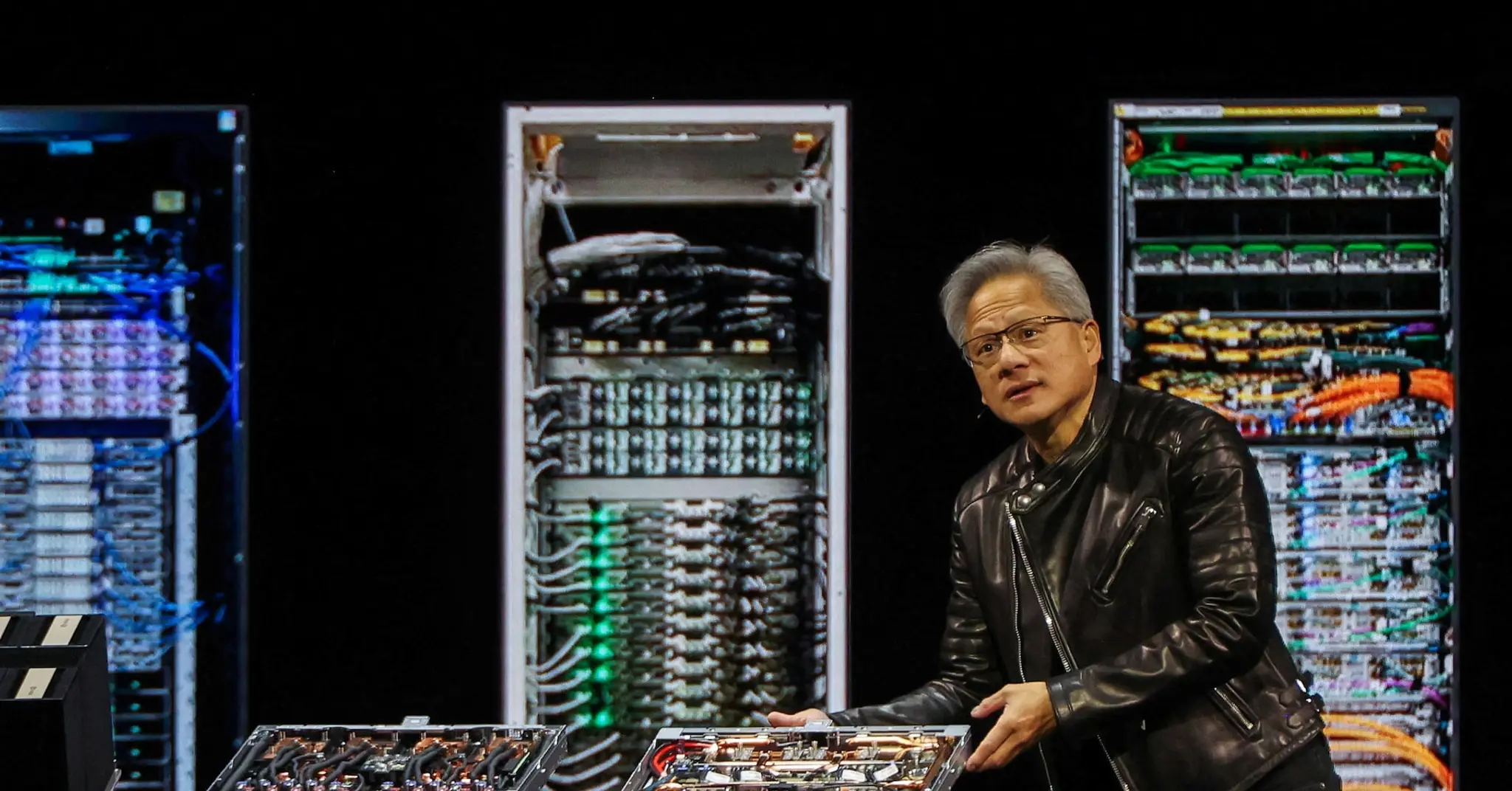

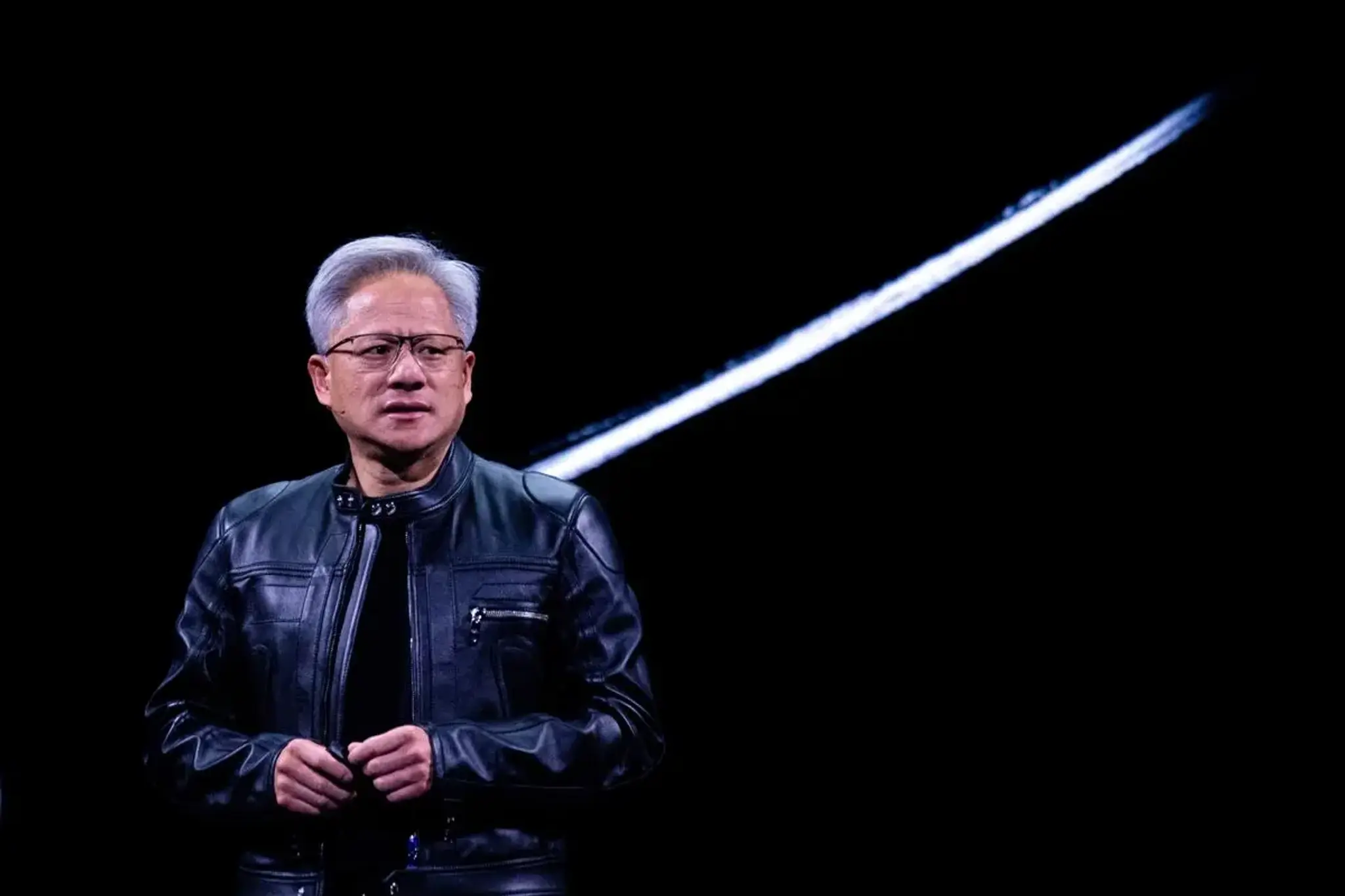

Nvidia is facing significant financial headwinds due to US licensing requirements impacting its H20 AI chip sales to China. In the first quarter of fiscal year 2026, the company incurred a $4.5 billion charge related to excess inventory and purchase obligations, alongside $2.5 billion in lost revenue from unshipped H20 chips. These restrictions are part of broader US export controls aimed at limiting China's access to advanced AI technologies.

Looking ahead, Nvidia anticipates an $8 billion revenue reduction in the second quarter due to these ongoing export limitations. The company is working to mitigate these losses by developing products tailored for markets subject to export controls and strengthening relationships with customers in unrestricted regions. Despite these challenges, Nvidia reported $4.6 billion in H20 sales for the first quarter before the new export licensing requirements took effect, with China accounting for 12.5% of overall revenue.

Analysts suggest that Chinese buyers stocked up on H20 chips ahead of the restrictions, boosting first-quarter sales. Nvidia is also focusing on its Blackwell NVL72 AI supercomputer and sees strong global demand for its AI infrastructure, despite the geopolitical and economic challenges.

Related Articles

Nvidia, AMD: China-bound AI Chips

Read more about Nvidia, AMD: China-bound AI Chips →

Nvidia Faces Rising Chinese Competition

Read more about Nvidia Faces Rising Chinese Competition →

Nvidia's China-Specific Blackwell Chip

Read more about Nvidia's China-Specific Blackwell Chip →

Nvidia requests China export relaxation

Read more about Nvidia requests China export relaxation →