Nvidia's upcoming earnings report is poised to either validate or deflate the recent tech stock surge, which has seen Nvidia's shares climb over 40% since April. As the last of the tech giants to report, Nvidia's performance carries significant weight, potentially setting the tone for the broader market. Investors are keenly watching whether the chipmaker can justify the high expectations, especially given its pivotal role in AI and data centre technologies.

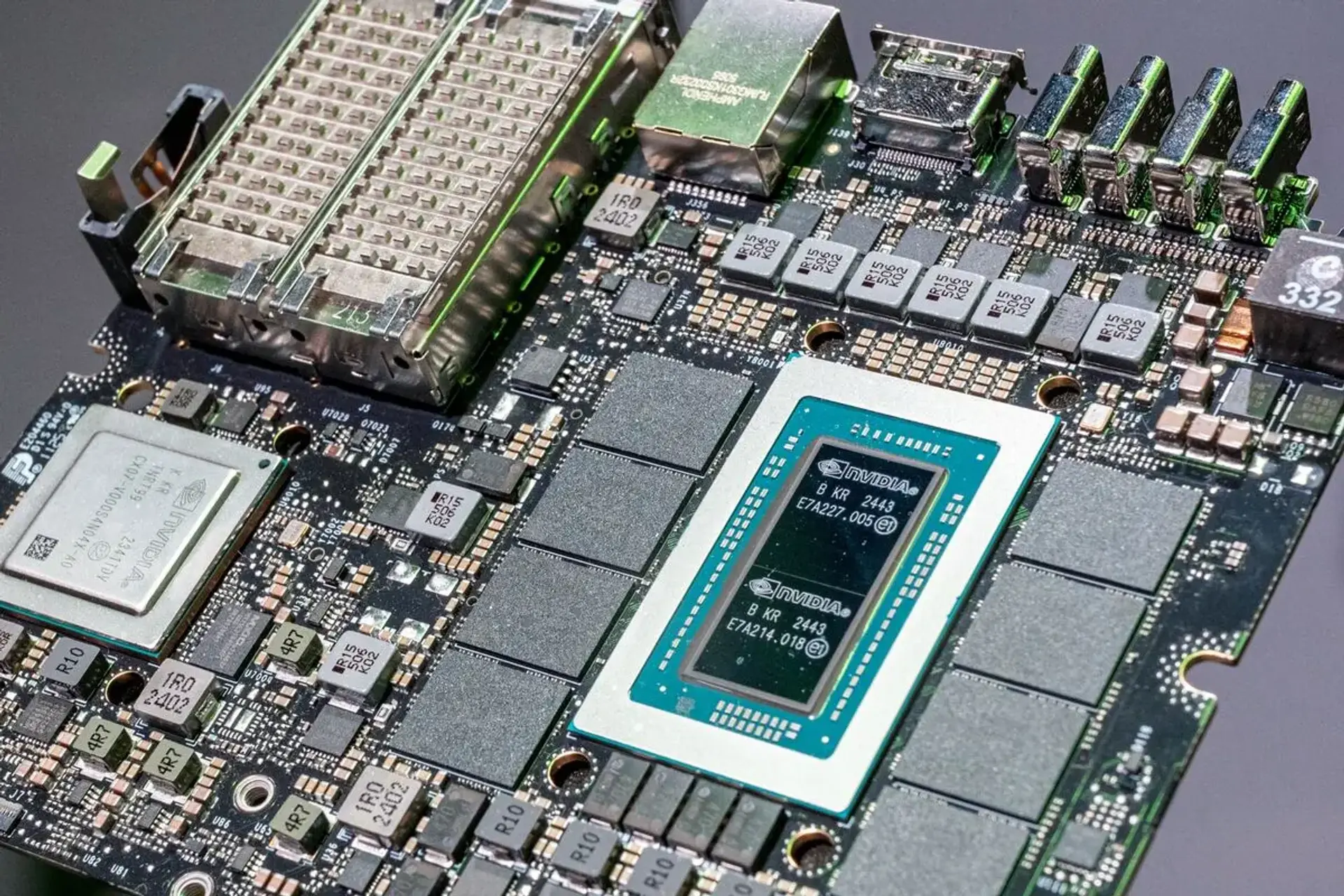

The company's earnings will be scrutinised for insights into the sustained demand for its high-performance GPUs, which are essential for AI development and cloud computing. Any signs of slowing growth or unmet expectations could trigger a market correction, impacting other tech stocks that have benefited from the same bullish sentiment. Conversely, a strong report could further fuel the rally, reinforcing confidence in the tech sector's growth trajectory.

Analysts predict that Nvidia's data centre business will be a key driver of growth, but the gaming sector's performance will also be closely monitored. The report will provide a comprehensive view of Nvidia's market position and its ability to capitalise on the ongoing AI boom, making it a crucial moment for both the company and the wider tech industry.

Related Articles

Nvidia earnings fuel market

Read more about Nvidia earnings fuel market →

Nvidia Earnings and Market Jitters

Read more about Nvidia Earnings and Market Jitters →

Nvidia eyes China AI market

Read more about Nvidia eyes China AI market →

AMD, Arm earnings preview AI

Read more about AMD, Arm earnings preview AI →