What happened

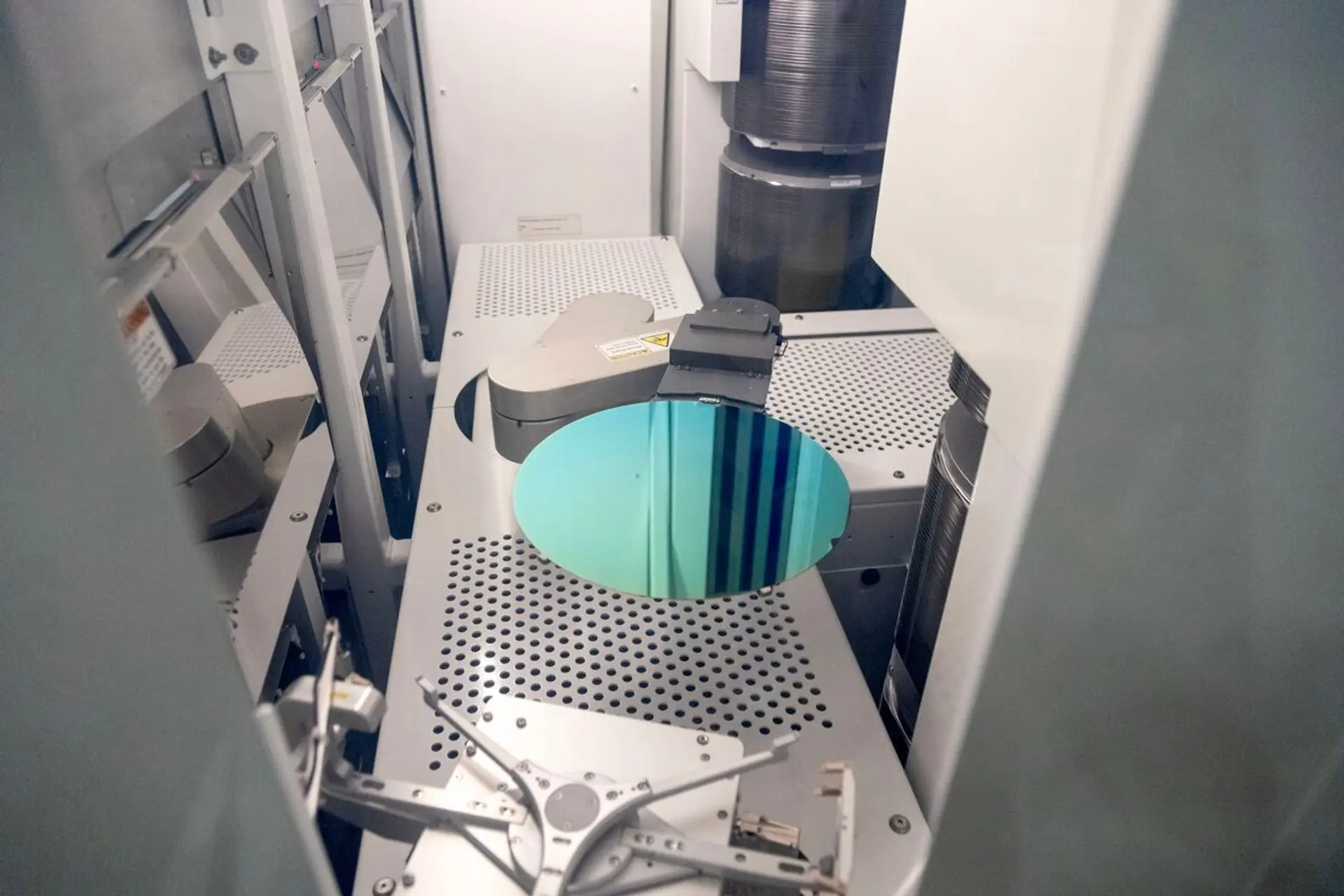

Micron Technology issued a sales forecast of $18.70 billion for the current quarter, driven by increased demand and limited supply of high-bandwidth memory (HBM) chips for AI data centres. This follows a 57% year-over-year revenue increase to $13.64 billion in the first quarter, with cloud memory sales doubling. Micron is prioritising AI demand through multiyear contracts and has increased its 2026 capital expenditure plans to $20 billion, positioning itself as a primary HBM supplier in a market projected to reach $100 billion by 2028.

Why it matters

The reported market conditions introduce a significant procurement constraint for organisations deploying AI infrastructure, specifically regarding high-bandwidth memory (HBM) components. Increased prices and limited supply of HBM, coupled with a shift towards multiyear contracts, reduce flexibility in sourcing and tighten dependencies on primary suppliers like Micron. This raises due diligence requirements for procurement and IT infrastructure teams to secure critical components, potentially impacting project timelines and budget allocations for AI initiatives.

Related Articles

China Limits Nvidia H200 Access

Read more about China Limits Nvidia H200 Access →

Moore Threads Skyrockets on Debut

Read more about Moore Threads Skyrockets on Debut →

Senators Aim to Block Chip Sales

Read more about Senators Aim to Block Chip Sales →

Samsung Pursues AI Chip Acquisitions

Read more about Samsung Pursues AI Chip Acquisitions →