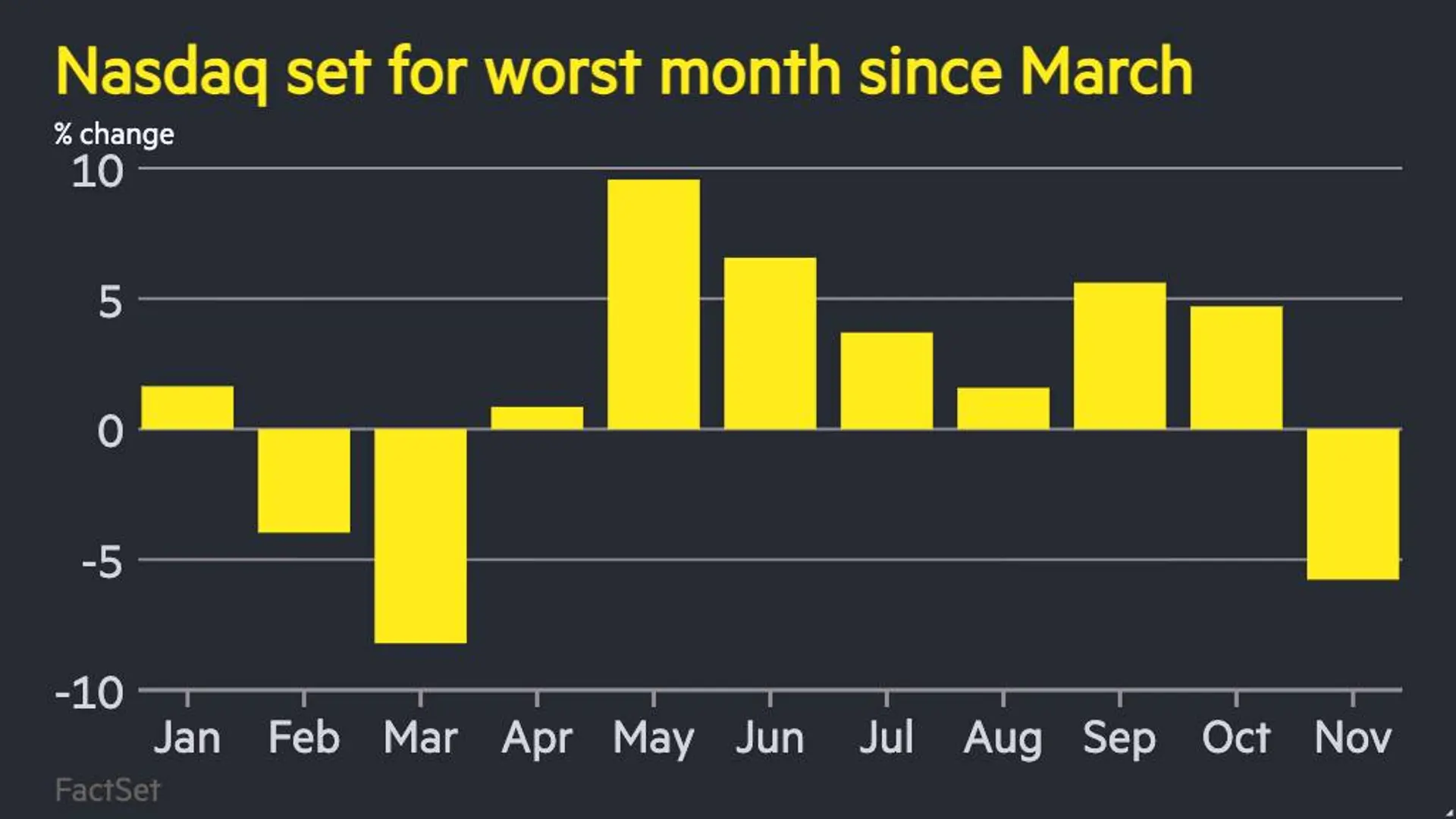

The European Central Bank (ECB) has cautioned that high valuations in the US technology sector, fuelled by 'fear of missing out' (FOMO), are creating vulnerabilities in the market. The central bank suggests that potential negative events, such as concerns regarding the independence of the Federal Reserve, could trigger a significant market correction.

The ECB highlights that current valuations appear stretched, increasing the risk of a sharp downturn. They also point to the concentration of gains within a small number of companies, particularly those related to artificial intelligence, as a factor that could amplify any market adjustments. A substantial shift in investor risk appetite or adverse developments in AI business models could also lead to a significant market correction, with potential knock-on effects for other economies.

The ECB's warning aligns with concerns raised by other financial institutions regarding potential risks in the financial markets. The central bank suggests investors should be aware of the possibility of a correction and the potential for broader economic consequences.