What happened

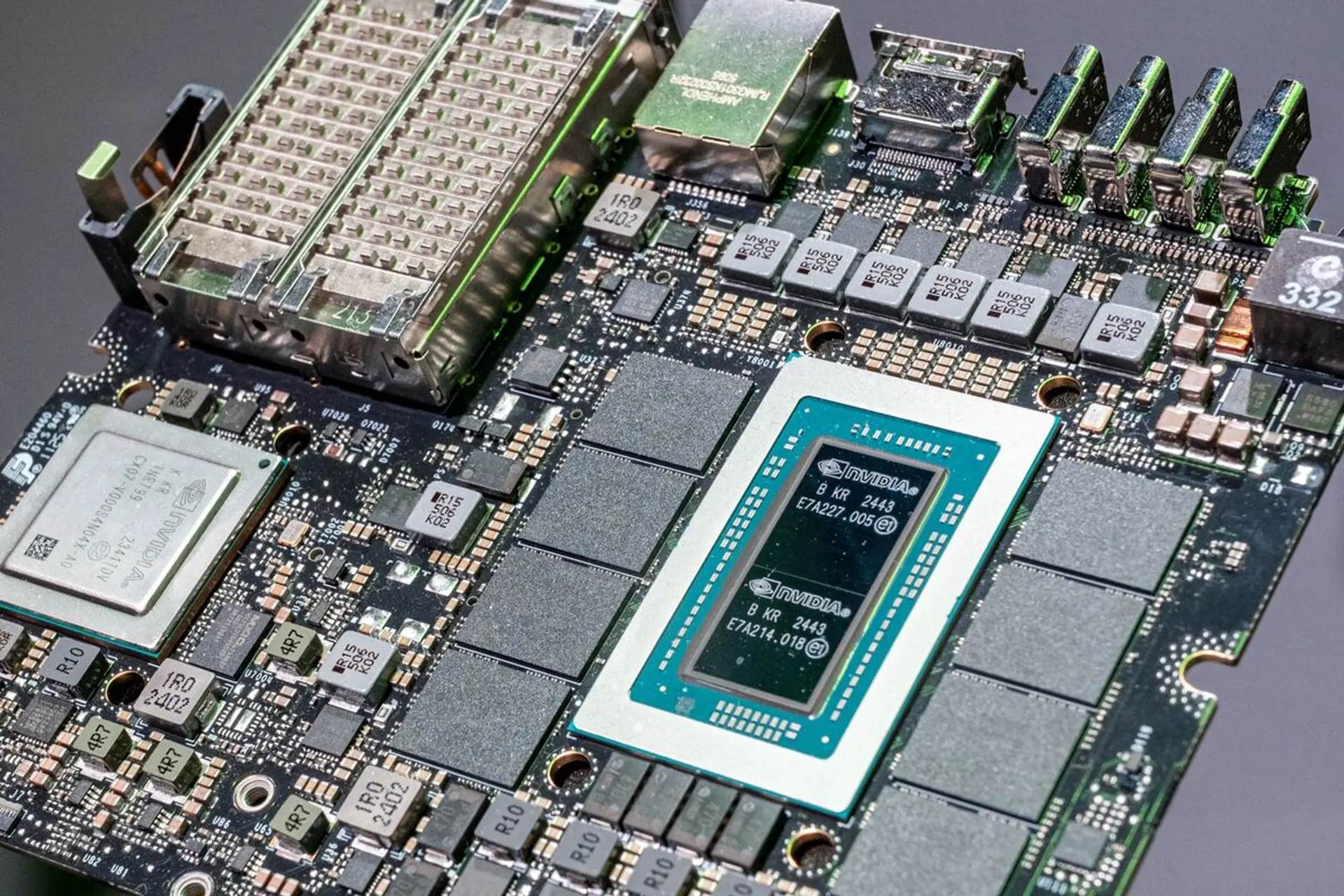

Nvidia reported Q3 revenue of $57 billion, a 62% year-over-year increase, with data centre revenue reaching $51.2 billion, up 55%. The company forecasts $65 billion for the next quarter and anticipates over $500 billion in business through late 2026, driven by data centre growth and Blackwell adoption. Customer bookings for AI chips now extend into 2026. This performance occurs amidst investor caution regarding data centre expansion costs and potential memory chip bottlenecks.

Why it matters

The extended customer bookings into 2026 and anticipated $500 billion business through late 2026 introduce a tightened dependency on Nvidia's AI chip supply chain, increasing procurement and operational planning burdens. This sustained demand, coupled with high data centre expansion costs and potential memory chip bottlenecks, raises due diligence requirements for IT infrastructure and supply chain teams to manage long-term hardware acquisition and cost efficiencies.